Trump, Powell, and the Crypto Comeback: Why Bitcoin Could Explode Past $100K

Table of Contents

Bitcoin’s Breakout Potential

Bitcoin (BTCUSD) saw a strong rally Monday, gaining over 4% and breaching the $88,300 mark—its highest point since early April when the Trump administration announced reciprocal tariffs against China.

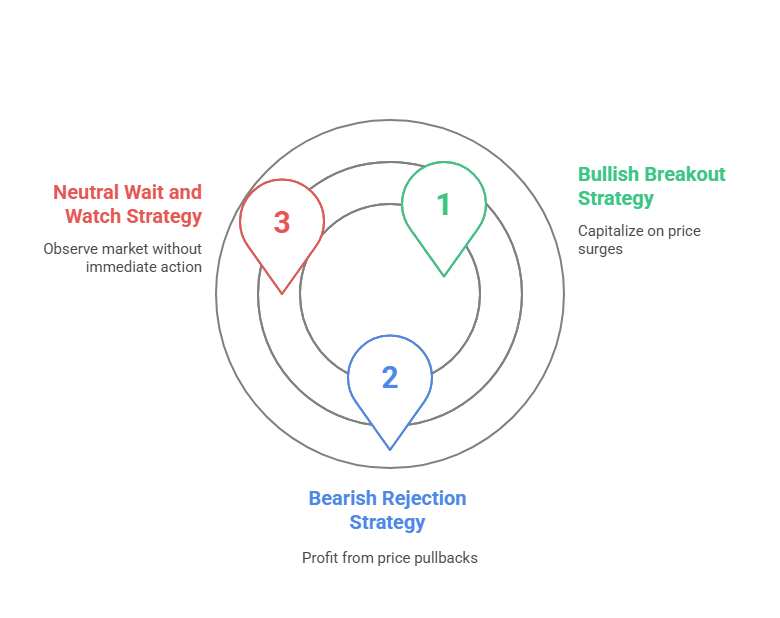

Although still approximately 20% below its all-time high (~$110,000 in mid-January), this upward move signals increasing momentum. Traders are closely watching the critical $90,000 resistance level; a decisive break above $90,000 could lead to a technical breakout, opening the path toward the psychological milestone of $100,000 and beyond.

Technical View: Bitcoin has been trading within a $75,000 to $90,000 consolidation range. A breakout above this band typically triggers new trend-following strategies among institutional and retail traders.

Macro Backdrop: Why Cryptos Are Rising Now

Several macroeconomic forces are aligning in favor of Bitcoin and other digital assets:

- Escalating Trade Tensions: U.S.-China relations are deteriorating again, making traditional equity markets volatile and unattractive.

- Trump vs. Powell: President Trump’s increasing criticism of Fed Chair Jerome Powell raises uncertainty about future monetary policy stability.

- Weakening Dollar: The U.S. Dollar Index (DXY) fell to a three-year low, historically a bullish catalyst for Bitcoin, gold, and other hard assets.

For investors, Bitcoin is once again being viewed not just as a speculative asset but as a macro hedge—similar to how gold reacts during times of monetary uncertainty.

Future Catalysts: Lower Rates and Fed Changes

A major bullish narrative for Bitcoin is emerging around potential changes in Federal Reserve leadership:

- If Trump removes Powell and appoints a more dovish Fed Chair, the probability of lower interest rates increases.

- Historically, lower rates and expansionary monetary policies weaken fiat currencies and boost demand for scarce assets like Bitcoin.

- Cantor Fitzgerald analyst Brett Knoblauch noted that Bitcoin and altcoins have historically thrived in low-rate, high-liquidity environments.

For medium- to long-term investors, policy changes at the Fed could set the stage for a sustained bull market in cryptocurrencies.

Altcoin Momentum: XRP, Ether, Solana

Other major altcoins are also participating in the rally:

- XRP, Ether (Ethereum), and Solana each rose roughly 2%.

- This suggests a broader market rotation into altcoins, often a positive confirmation of a bullish market structure for cryptos.

- Traders may consider positioning into high-quality altcoins to capture additional upside if the rally extends.

Institutionalization of Crypto: Banking Licenses

In parallel, there’s growing institutional interest:

- Circle and BitGo are pursuing bank charters or limited licenses to issue stablecoins and operate like traditional lenders.

- Coinbase is also exploring licensing options to strengthen its position in a potentially regulated future.

Why it matters: Regulatory clarity and deeper integration into the traditional financial system would legitimize crypto further, lower perceived risks, and attract institutional capital. This could lead to structural, long-term upside for Bitcoin and select digital assets.

Takeaways

| Focus Area | Implication | Suggested Action |

|---|---|---|

| Technical Breakout | Watch $90,000 for Bitcoin | Consider scaling into positions on breakout confirmation |

| Macro Weakness | Stocks volatile, dollar weak | Increase crypto/gold exposure as hedge |

| Policy Change Potential | Trump vs. Powell, dovish shift? | Monitor Fed developments closely |

| Altcoin Strength | XRP, Ether, Solana rising | Diversify into top-performing altcoins selectively |

| Institutional Moves | Crypto firms seek licenses | Long-term bullish: monitor stablecoin regulations |

This isn't just a short-term bounce—it could be the beginning of a larger macro-driven move for Bitcoin and major cryptos. Smart investors and traders should stay alert, disciplined, and ready to act on clear breakout signals, all while keeping an eye on broader geopolitical and monetary developments.

SmartMoney Newsletter

Join the newsletter to receive the latest updates in your inbox.