Tesla Just Posted a 71% Profit Crash—Here’s Why the Stock Surge Can Be a Trap

Table of Contents

When Earnings Crash But Stock Soars: A Warning Sign

Tesla's recent earnings report was undeniably disappointing, yet puzzlingly, the stock price has climbed. This counterintuitive reaction creates a dangerous trap for everyday investors. As legendary investor Peter Lynch once warned: "Know what you own, and know why you own it." This report breaks down why today's Tesla stock movement deserves your skepticism.

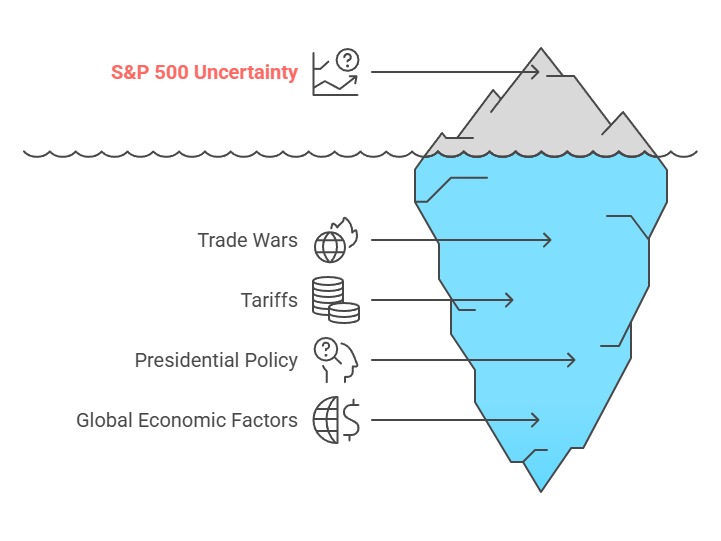

The Earnings Reality Check

Tesla's latest quarterly results revealed several troubling signs:

- Revenue growth significantly below Wall Street expectations

- Profit margins continuing to compress

- Market share under pressure from growing competition

- Product roadmap uncertainties persisting

As Warren Buffett famously said: "Only when the tide goes out do you discover who's been swimming naked." Tesla's financial tide appears to be receding.

The Stock Price Rollercoaster: Understanding the Phases

Phase 1: The Misleading Relief Rally (Happening Now)

The current stock price jump despite poor earnings is what Wall Street calls a "relief rally" – a temporary upward movement that often misleads retail investors.

Why this happens:

- Results were bad but not catastrophically bad

- Short-sellers are buying shares to cover their positions

- Algorithmic trading programs responding to surface-level headlines

Real-world example: It's like receiving a credit card bill that's painfully high but slightly less than you feared. Your momentary relief doesn't change the fact that you're still in financial trouble!

"The market can remain irrational longer than you can remain solvent." — John Maynard Keynes

Phase 2: The Analyst Awakening (Coming Soon)

Over the next few days, professional analysts will dig deeper into Tesla's numbers:

- Financial models will be recalculated with disappointing data

- Price targets likely adjusted downward

- Potential downgrades from "buy" to "hold" or "sell"

Real-world example: Think of it like a home inspection after an initial walk-through. The charming house (Tesla) looked great at first glance, but now the inspector is finding foundation cracks, electrical problems, and plumbing issues.

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine." — Benjamin Graham

Phase 3: The Public Perception Shift (Days 5-14)

As the full earnings story spreads:

- Media coverage becomes increasingly critical

- Social media sentiment typically turns negative

- Retail investors begin to understand the implications

- Trading volume increases as positions are reconsidered

Real-world example: Remember how quickly public opinion turned against WeWork once people looked beyond the hype and examined the actual business model? Initial excitement can quickly transform into skepticism.

"What the wise do in the beginning, fools do in the end." — Warren Buffett

Investment Principles Every Tesla Investor Needs to Know

1. The Dangerous Price-Value Gap

Tesla's current stock price may have dangerously disconnected from its business fundamentals.

Real-world example: During the housing bubble, homes were selling for prices that made no sense compared to rental income or local wages. Eventually, reality caught up.

"Price is what you pay, value is what you get." — Warren Buffett

2. The Momentum Mirage

Tesla has historically traded on momentum and future promises rather than current financial performance.

Real-world example: Remember Peloton during the pandemic? Momentum pushed it to $170/share before crashing below $10 when reality set in.

"The four most dangerous words in investing are: 'This time it's different.'" — Sir John Templeton

3. The Greater Fool Trap

Some investors may be buying Tesla not because of its value but because they believe someone else will pay more later.

Real-world example: During the cryptocurrency boom of 2021, people bought tokens with no utility simply because prices were rising, only to see values collapse when new buyers disappeared.

"The stock market is filled with individuals who know the price of everything, but the value of nothing." — Philip Fisher

4. The Hidden Opportunity Cost

Money tied up in Tesla while it potentially stagnates or declines means missing opportunities elsewhere.

Real-world example: Investors who remained all-in on Netflix after its 2021 peak missed the recovery in other tech stocks that performed well in 2023.

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas." — Paul Samuelson

What Smart Investors Should Do Now

1. Practice Patience

Resist the urge to make impulsive decisions based on a single day's stock movement.

"The stock market is a device for transferring money from the impatient to the patient." — Warren Buffett

2. Diversify Your Holdings

If Tesla represents more than 5% of your portfolio, consider whether you're taking excessive risk.

Real-world example: Imagine putting 25% of your savings into a single restaurant chain. If that chain faces health violations or changing consumer tastes, your financial future would be severely impacted.

"Don't put all your eggs in one basket." — Grandma was right all along

3. Set Emotion Aside

FOMO (Fear Of Missing Out) is a terrible investment advisor.

Real-world example: People who bought GameStop at $400 because they feared missing the next big thing learned a painful lesson when it crashed below $50.

"The investor's chief problem—and even his worst enemy—is likely to be himself." — Benjamin Graham

4. Consider Gradual Exits

Rather than all-or-nothing decisions, consider scaling out of positions.

Real-world example: Instead of selling all 100 shares at once, selling 25 shares each week for four weeks often results in a better average price and less regret.

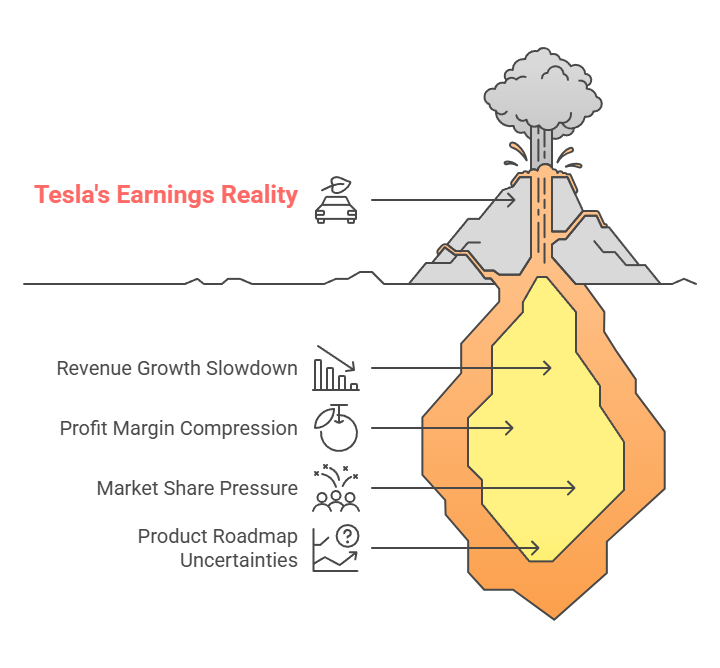

Is Bad News Already Priced In? The Dangerous Assumption

Many Tesla bulls argue that the stock's rise despite poor earnings suggests "the bad news is already priced in." This seductive narrative deserves serious scrutiny.

The Psychology of "Priced In" Claims

When investors claim negative news is "priced in," they're suggesting the market has already accounted for all possible downsides. History repeatedly shows this assumption to be dangerous.

Real-world example: In 2007, many claimed housing concerns were "priced in" to financial stocks. When Lehman Brothers traded at $30 (down from $86), some called it a bargain. It eventually went to zero.

"The four most expensive words in the English language are 'this time it's different.'" — Sir John Templeton

Why "Priced In" Often Proves Wrong

Several factors make the "priced in" argument particularly suspect for Tesla right now:

- Deteriorating Fundamentals: Tesla's margins have declined for six consecutive quarters – a trend, not a one-time event.

- Competitive Landscape Shift: Chinese EV makers are expanding globally with lower-priced alternatives while traditional automakers are improving their electric offerings.

- Valuation Reality: Despite recent declines, Tesla still trades at a premium compared to other automakers. Ford and GM trade at roughly 5-6x earnings while Tesla trades at over 60x earnings.

Real-world example: Netflix investors in 2021 believed slowing subscriber growth was "priced in" at $700/share. The stock subsequently fell below $200 as the full impact of competition and market saturation became apparent.

"Markets can remain complacent much longer than you expect, but when they do respond, the reaction can be much more severe than you could imagine." — Michael Burry

The Danger of Confirmation Bias

Investors often seek information that confirms their existing beliefs while dismissing contradictory evidence.

Real-world example: BlackBerry enthusiasts ignored iPhone's threat for years, believing BlackBerry's business model was secure. The stock fell from $140 to under $10 as reality gradually set in.

Conclusion: The Road Ahead

Tesla remains an innovative company with passionate supporters, but today's stock price reaction to poor earnings should raise red flags for prudent investors. As Howard Marks wisely noted: "Being too far ahead of your time is indistinguishable from being wrong."

The coming days will likely reveal whether today's stock jump was the start of a sustainable recovery or merely a brief pause in a challenging period for Tesla shareholders. Until the picture becomes clearer, caution is the wisest approach.

Remember: "Risk comes from not knowing what you're doing." — Warren Buffett

Smart investors don't confuse a rising stock price with a healthy company. They look beneath the surface, understand the fundamentals, and make decisions based on value rather than hype. Today's Tesla price action demands exactly that kind of careful scrutiny.

Disclaimer:

This blog is for educational purposes only and not financial advice.

Always do your own research and consult a financial advisor before investing.

SmartMoney Newsletter

Join the newsletter to receive the latest updates in your inbox.