Stock Futures Drop Amid Rising Trade Tensions and Fed Uncertainty

Table of Contents

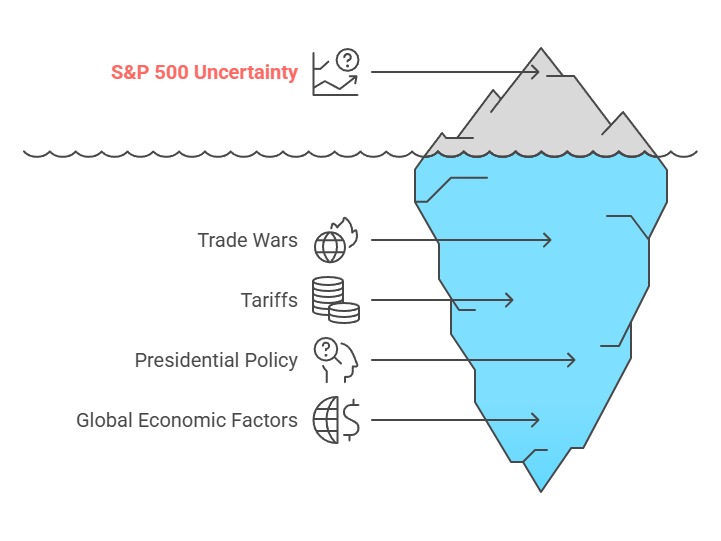

Stock futures were falling on Monday because traders were worried about two big things:

- "Ongoing trade fights between the U.S. and other countries."

- "Fear that President Trump might fire the head of the U.S. central bank (the Federal Reserve) to force lower interest rates."

Before the stock market opened, the main U.S. indexes were already down:

- Dow Jones futures dropped by 349 points (about 0.9%).

- S&P 500 futures fell by 1%.

- Nasdaq 100 futures fell even more, down 1.1%.

Last Friday, a White House advisor said the Trump team was checking if they could "remove Jerome Powell, the Fed Chair."

This worried investors because it would create "uncertainty about how interest rates would be handled," and the stock market usually doesn’t like surprises.

At the same time, China warned it would "fight back if any country makes a trade deal that hurts China’s interests."

This made investors even more nervous about future trade problems.

Trump’s comments about the Fed also affected other markets:

- The U.S. dollar dropped against other currencies (falling 0.9%).

- Gold prices shot up 2.3%, reaching a new record high.

- Oil prices dropped, with Brent crude falling 1.5% and West Texas oil down 1.6%, because traders worried that higher tariffs could slow down the global economy and lower oil demand.

The 10-year U.S. Treasury yield rose slightly (by 0.04%), meaning bond prices fell a little.

When the 10-year U.S. Treasury yield goes up, it means investors are demanding higher returns to hold government bonds. Since bond prices and yields move in opposite directions, a rising yield means bond prices fell a little.

This usually happens because investors are feeling less confident about the market (like worrying about trade wars or political drama) and expect either more inflation or more risk ahead. Higher yields can also make borrowing more expensive for businesses and consumers, which can slow down economic growth and hurt stock prices.

SmartMoney Newsletter

Join the newsletter to receive the latest updates in your inbox.