Bitcoin is Boiling: Trade or Wait? Beginner’s Guide to What’s Next

Table of Contents

Current Bitcoin Price Snapshot

As of April 23, 2025, Bitcoin is trading at $93,598, showing a strong surge from earlier April lows. This rally puts Bitcoin in a critical zone where it could either continue pushing higher or face a short-term pullback.

"Markets are stories people tell each other. And right now, the story of Bitcoin is full of excitement and caution at the same time."

The price is now approaching a key technical zone that offers several trade opportunities, both for bullish and bearish traders.

Key Market Levels to Watch

Resistance Levels (Potential Ceilings):

- $96,000 – A psychological barrier and recent price ceiling. Breaking this level would confirm strong bullish momentum.

- $100,000 – A major milestone that may bring in heavy profit-taking or hesitation.

Support Levels (Potential Floors):

- $91,500 – Minor support level that recently acted as resistance; may now hold price up.

- $88,000 – Strong historical support level where many buyers stepped in before.

These levels are like boundaries where price movement may pause, reverse, or explode through, depending on market strength.

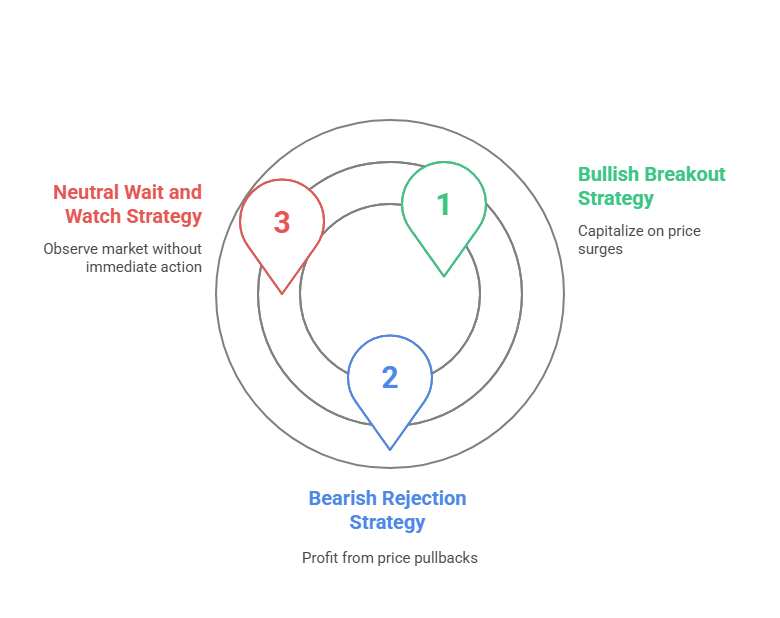

Three Clear Trading Ideas for Today

1. Bullish Breakout Strategy

If Bitcoin pushes above $96,000, it could continue rising toward the next big target at $100,000.

Plan:

- Enter trade when the price closes above $96,000 on strong trading volume.

- Set stop-loss at $91,500 to protect against a sudden reversal.

- Target take-profit at $100,000.

"Don’t chase the breakout, wait for confirmation. Let the price prove its strength."

This strategy works best when you see price holding above $96K for a few hours or more. Look for increasing volume as confirmation.

2. Bearish Rejection Strategy

If Bitcoin fails to break $96,000 and begins falling below $91,500, a short-term pullback toward $88,000 becomes likely.

Plan:

- Enter trade if price closes below $91,500 and shows weak momentum.

- Set stop-loss above $93,000.

- Take-profit around $88,000.

This strategy plays on the possibility that buyers are running out of energy near the $96,000 level.

"Failure to break resistance often leads to short-term corrections."

3. Neutral ‘Wait and Watch’ Strategy

If you’re uncertain, it’s perfectly okay to stay on the sidelines. This market is near decision levels, and clarity could emerge soon.

Plan:

- Monitor the range between $91,500 and $96,000.

- Use price alerts or demo trading to stay engaged.

- Wait for a clear breakout or breakdown to confirm direction.

"The best trades often come from patience, not prediction."

This is the safest strategy for beginner investors who want to avoid guessing in volatile situations.

Basic Definitions for Beginner Investors

Resistance: A price level where selling pressure usually prevents the price from rising further. It’s like a ceiling in a room—price keeps hitting it but can’t break through until there’s enough strength.

Support: A price level where buying interest usually prevents the price from falling further. Think of it as a floor that price often bounces off of.

Breakout: A breakout happens when the price moves through a resistance or support level with strong momentum. A breakout above resistance is usually bullish; a breakdown below support is bearish.

Stop-Loss: A tool used by traders to automatically exit a trade if the price moves against them beyond a certain point. This helps control risk.

Take-Profit: The price level at which a trader plans to exit a trade and lock in profits.

Volume: Refers to how many trades are happening in a given period. High volume during a price move adds strength to that move.

Final Thoughts

Bitcoin is currently at a critical decision point. The recent rally has brought it close to a major resistance zone at $96,000. If buyers remain strong, we could see a test of $100,000 soon. But if momentum fades, a short-term dip to $88,000 is likely.

Beginner traders should focus on confirmation rather than anticipation. The smartest move is to trade zone by zone, react to what the price shows you, and always manage risk with stop-losses.

"In trading, your job is not to predict the market, but to prepare for what it might do."

Disclaimer:

This thread is for educational purposes only and not financial advice.

Always do your own research and consult a financial advisor before investing.

#Bitcoin #BTC #CryptoTrading #CryptoForBeginners

SmartMoney Newsletter

Join the newsletter to receive the latest updates in your inbox.