Another Week, Another Roller Coaster: Should You Jump In or Watch the Ride?

Table of Contents

Buckle up — because this market ride feels like a roller coaster that forgot to brake!

One moment you’re up in the clouds, the next — whoosh — your stomach’s in your shoes.

Here’s the reality:

- The major stock indexes kicked off the week by sliding more than 1% — and there wasn’t even any big bad news to blame.

- No huge company bankruptcies. No sudden economic crashes.

- Just good old fear swirling around about tariffs, trade wars, and wild rumors.

In simple words:

The market is panicking — even when there’s no fire.

Are These Normal Times? Not Even Close.

Experts are shouting it from the rooftops:

- This level of market madness reminds them of the Great Financial Crisis of 2008, when banks crumbled, and stocks tanked 50%.

- It’s also a flashback to 2020, when the COVID-19 pandemic wiped out trillions of dollars in stock value in just a few weeks.

But guess what happened after those disasters?

- In 2008, brave investors who didn’t panic saw the market double and triple by 2011.

- In 2020, those who bought during the crash made huge gains within months.

Moral?

The market falls hard, but it usually rises even harder.

So, How Bad Could It Get Now?

Today’s confusion is mainly about trade wars and tariffs, not banks collapsing.

Still, experts are warning:

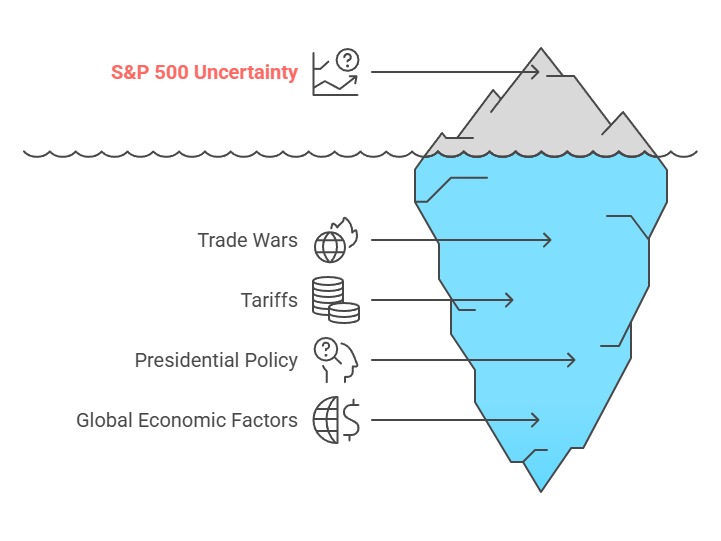

- The S&P 500 index (which is like a "health meter" for the stock market) could end the year anywhere between 4,000 and 6,000.

- That’s a crazy spread — like trying to predict whether tomorrow will be a drizzle or a hurricane!

Why the huge uncertainty?

Because one person’s policy (hint: the US President’s trade moves) could swing things dramatically, almost overnight.

What Does This Mean for Everyday Investors Like You?

Simple:

- Volatility is here to stay.

- You’ll see big ups and downs — sometimes in the same day!

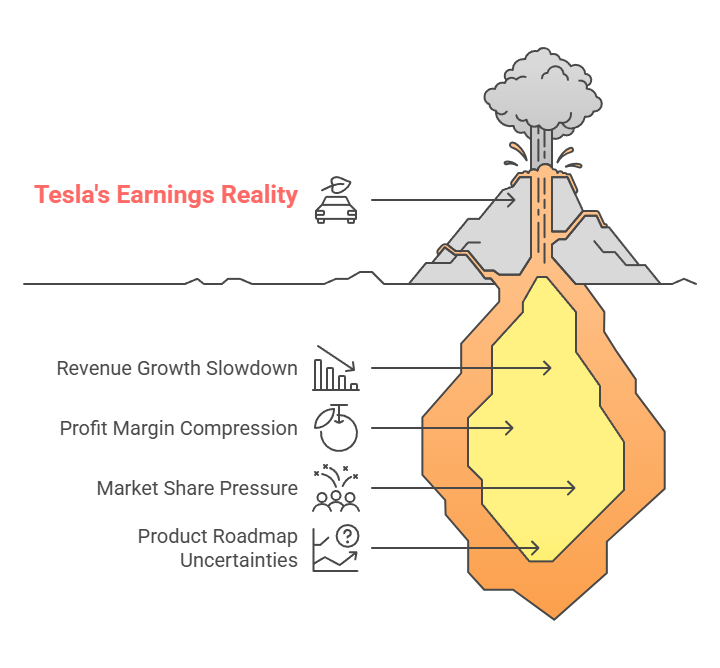

And if you’re wondering about earnings —

Companies are expected to make less money this year.

The average full-year earnings estimate has already dropped from $272 to $265 per share — and it might fall even more.

Some experts are even saying:

Forget 2025. The real money-making opportunities could start showing up in 2026!

So, What Should YOU Do Now?

If you’re nervous, you’re not alone.

Here are two smart paths:

Option 1: Stay calm and sit tight.

- If you’re unsure, it’s okay to watch from the sidelines for now.

- Protect your money, stay patient, and keep learning.

Option 2: Be a strategic dip buyer.

- If you have the courage (and a plan!), you could use the big drops to buy quality stocks at discounts — just like smart investors did in 2008 and 2020.

- Remember: Buying when others are scared has often made fortunes.

Real-World Example:

- In March 2009, when everyone thought the world was ending, brave investors who bought stocks saw their money triple in the next few years.

- In April 2020, smart buying led to 50%+ gains in just one year!

Quick Tip: Watch the Fear Meter (VIX)

Right now, Wall Street’s "fear meter" — the VIX — is way higher than normal.

- When the VIX spikes, it usually means more bumps ahead — but also big opportunities if you’re patient.

- History says that after crazy volatility, the markets often rebound strongly.

SmartMoney Newsletter

Join the newsletter to receive the latest updates in your inbox.